The ‘donut effect’ represents a tangible shift in consumer behaviour: people are increasingly shopping outside of city centres in residential districts and peripheral suburbs. Commercial activities are shifting to the places where people live and work. City centre retailers are losing ground, while peripheral locations are very much on the up. This trend is not just down to online retail, but is primarily explained by permanent changes in the working environment. Working from home has reduced people’s sphere of activity and movement patterns.

Based on aggregated payment data, the Gottlieb Duttweiler Institute compared consumer spending in city centres with peripheral suburbs. The new analysis reveals that the shift in terms of footfall and sales, which first became evident between 2020 and 2022, will continue into 2025. The ‘donut effect’ has become a reality.

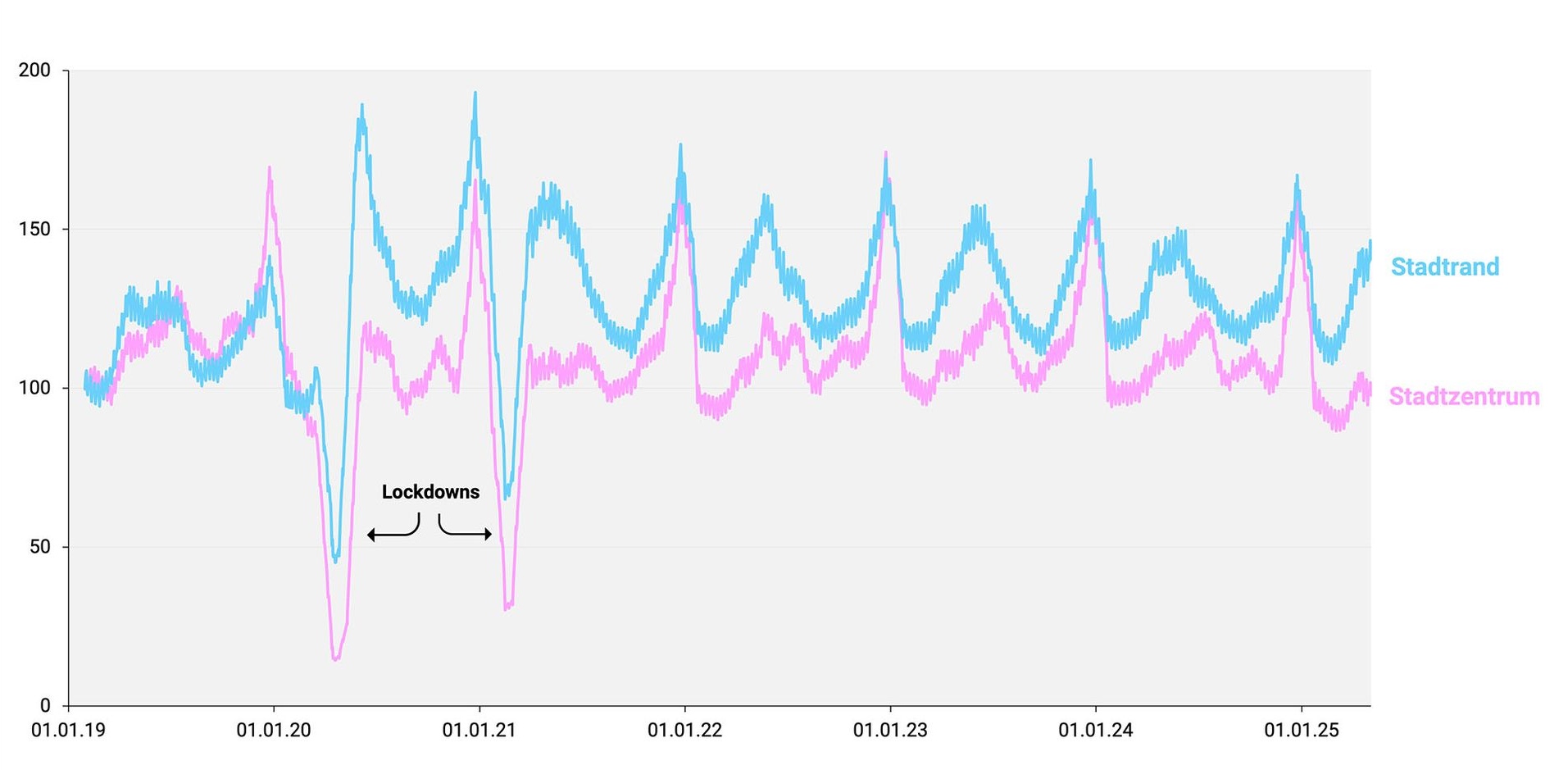

Swiss consumer spending in the non-food sector

(Card payments, indexed: January 2019 = 100)

Consumer spending in Swiss city centres and suburban districts between 1 January 2019 and 4 May 2025 (rolling 30-day average)

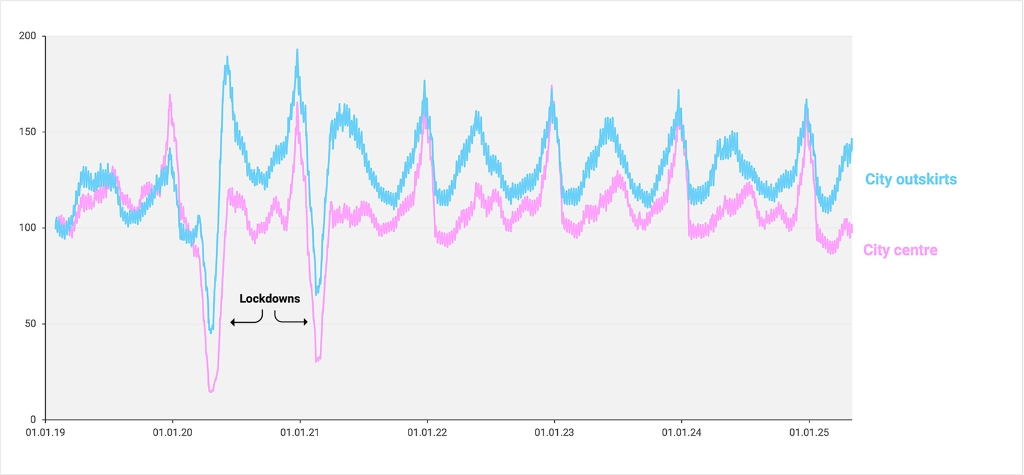

Consumer spending in Swiss city centres and suburban districts between 1 January 2019 and 4 May 2025 (rolling 30-day average)Swiss consumer spending in the non-food sector

(Card payments, indexed: January 2019 = 100)

Consumer spending in Swiss city centres and suburban districts between 1 January 2019 and 4 May 2025 (rolling 30-day average)

Consumer spending in Swiss city centres and suburban districts between 1 January 2019 and 4 May 2025 (rolling 30-day average)In the outskirts, bricks-and-mortar, non-food retail sales in April 2025 were up by around 40% on the figure for January 2019. By comparison, city centres have struggled to recover and their sales are actually down by 1%. This means the new consumer geography is clearly evident with a shift away from city centres towards peripheral suburbs.

Change driven by home working

Even though the trend has declined slightly again, over a third of employees in the canton of Zurich are still working from home on a regular basis. Everyday activities - and so too consumption - are moving closer to home. People who are no longer commuting to the office every day are shopping locally more often – in their local neighbourhood, on the way to the playground or after a visit to the gym. This is not only changing the geographical distribution of consumption, but also expectations in the retail sector.

The principle of proximity is becoming an increasingly key factor. Proximity signifies more than simply short distances. It is the combination of accessibility, familiarity, personal advice and direct product experience. The quantitative element - saving time - is complemented by a qualitative one: proximity conveys a sense of trust, personal contact and appreciation. Especially in a retail industry that is increasingly being shaped by AI, automation and anonymised platforms, local and human proximity is providing an emotional counterbalance. .

Proximity – a strategic success factor

Proximity is more than just a nostalgic notion. It provides a solution to the challenges presented by the relocation of urban consumption, technological alienation and the decline of city centre retail locations. For bricks-and-mortar retailers, this means securing a central location is no longer the key factor, but instead establishing a local presence. Retailers must focus on where people actually live, not where they used to work.

But how exactly can proximity be achieved in an increasingly hybrid world? The 75th International Retail Summit being held at the Gottlieb Duttweiler Institute in Rüschlikon provides answers to these questions. At an event entitled ‘Nearconomy: Trust Beyond Transactions’, visionary thinkers and industry experts will explore how retailers can build closer relationships with their customers physically, digitally and emotionally - thereby creating ‘trust beyond transactions’.

Method

The analysis is based on data from Monitoring Consumption Switzerland a joint initiative of the University of St. Gallen, the University of Lausanne-E4S and Novalytica that is supported by SIX, Worldline and the Swiss Payments Association. Daily, aggregated and anonymised card payments in bricks-and-mortar, non-food retail (no e-commerce transactions) between 1 January 2019 and 4 May 2025 were analysed. To analyse the ‘donut effect’, sales figures in city centres were compared with those in suburban districts. This approach is based on the classification used by the Federal Statistical Office (FSO).